- Details

- Written by: Kamran Mofid

- Hits: 3847

First came the US sub-prime mortgage meltdown. Now entire towns are declaring bankruptcy

Photo:parade.com

“They were hanging up the bunting in Mammoth Lakes this week, celebrating Independence Day in the traditional small-town fashion. First, locals queued up for an eat-all-you-can-eat "pancake breakfast". Then they took part in a fiercely contested "hot-dog-eating contest". Finally, after witnessing the annual town parade, the community oohed and aahed over a short but patriotic fireworks display.

Yet behind the show of civic pride lay a palpable sense of unease. For all the conspicuous consumption of junk food, and the proudly worn stars-and-stripes paraphernalia, locals were grimly aware that their picturesque resort, in California's Sierra Nevada mountains, was making headlines for all the wrong reasons.

The previous day, local councillors voted unanimously to seek bankruptcy, after Mammoth Lakes found itself facing a bill of $43m (£28m) from a botched property deal. The town, in winter a popular ski destination, became the state's second municipality in a less than a week to suddenly declare itself insolvent. Officials issued a statement claiming "bankruptcy, unfortunately, is the only option left", after a court ordered it to immediately pay the $43m to its largest creditor. It remains unclear how local police, firefighters, and core services will continue to be funded.”…

The towns left in financial ruin

Stockton, California

The biggest city in the US to run out of money so far, it listed a debt of $1bn in its bankruptcy application last month

Mammoth Lakes, California

The ski town filed for bankruptcy this week after losing a legal fight costing twice its annual budget

West Fall, Pennsylvania

The economy was doing well in this small town yet its $20m debt still proved too big for it to cope with

Jefferson County, Alabama

Failure to restructure $3.1bn bonds on its sewers sent its finances down the drain

Central Falls, Rhode Island

Went broke last year due to its massive pension bill for the baby boomers among its 18,000 citizens

Vallejo, California

Debt led to police officers being laid off, fire stations being closed, and cuts imposed on other services in 2008

Moffett, Oklahoma

Raised 78 per cent of its income from speeding tickets – until a state-imposed ban on the fines made it insolvent in 2008

Pritchard, Alabama

When town ran out of money for pensions in 2009, it simply stopped paying them, but that was not enough

Read more:

Broken America: The towns left in financial ruin

- Details

- Written by: Kamran Mofid

- Hits: 4686

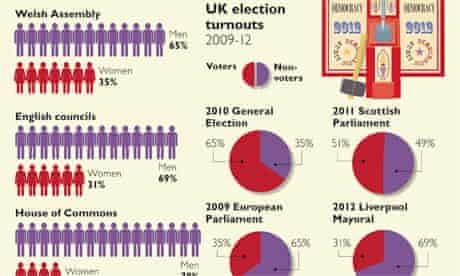

Continuing on my Blog postings “Britain engulfed in corruption” highlighting the major deficiencies of crony capitalism in the UK, today our attention should also be focused on “Deficient British democracy”.

British democracy in terminal decline

Exclusive: Corporate power, unrepresentative politicians and apathetic voters leave UK 'increasingly unstable'

“A study into the state of democracy in Britain over the last decade warns it is in "long-term terminal decline" as the power of corporations keeps growing, politicians become less representative of their constituencies and disillusioned citizens stop voting or even discussing current affairs.”…

The report “found evidence of many other areas where Britain appeared to have moved further away from its two benchmarks of representative democracy: control over political decision-making, and how fairly the system reflects the population it represents – a principle most powerfully embedded in the concept of one person, one vote.”…Continue to read

2012 Democratic Audit: British democracy in 'terminal decline'. Get the data

Photo:theguardian.com

- Details

- Written by: Kamran Mofid

- Hits: 5989

Barclays insider lifts lid on bank's toxic culture

Bob and his mates. Photo: Financial Times

“A former senior Barclays employee today exposes the “culture of fear” that operated at the bank and claims Bob Diamond would have been aware of his traders' activities.

Speaking exclusively to The Independent, the banker alleges that senior executives would have known of Libor fiddling in 2008.”…

“Punishing hours, victimisation, physical intimidation, arbitrary dismissal. Such is the portrait of working conditions under Bob Diamond described by a former employee in today's Independent. Perhaps those Barclays Capital bankers deserved their bonuses after all, just for putting up with him.

Now I doubt many people thought trading floors were a sanctuary of civility, gentility and compassion. Based on my experience at Bank of America in the 1990s, I would say they are Darwinian environments where large egos prosper and sensitive souls suffer. But I never witnessed the kind of fist-bashing detailed by the whistleblower. Nor the paranoid centralisation of power. Nor the shameless favouritism”…

Read more:

Exclusive: Barclays insider lifts lid on bank's toxic culture

Dan Gledhill: No one thinks the City is a picnic. But this was brutal

Business Ethics, Corporate Social Responsibility and Globalisation for the Common Good

The Barclays scandal, Bob Diamond, the Riots, and the Rioters: Where is Justice?

Whatever Happened to the Moral Compass? Britain engulfed in corruption

- Crime of the Century: Forget Madoff, Enron, Ken Lay…Think Libor!

- My Guest Blogger Peter Bowman: Good and Bad Taxes

- Britain engulfed in Corruption: Costs& Consequences

- Britain engulfed in corruption Part IV: Is Britain more corrupt than it thinks?

- My Guest Blogger Steve Szeghi: Student Loan Debt in the United States, Time to Forgive